How and why should we study ‘economic complexity’?

The differences between the economies of Switzerland and Guatemala go beyond differences in size. The Swiss economy has different inputs that can be used to produce a very different mix of outputs. In other words, the Swiss economy has different ‘productive capabilities’.

Productive capabilities are important to understand economic development. But, what exactly are productive capabilities? And how can we measure them?

Ricardo Hausmann and Cesar Hidalgo argue that productive capabilities are all the inputs, technologies and ideas that, in combination, determine the frontiers of what an economy can produce. They argue that productive capabilities include all sorts of things: infrastructure, land, laws, machines, people, books, and collective knowledge.

Since measuring and comparing such diverse and complex productive capabilities is difficult, Hausmann and Hidalgo propose using a proxy, called the Economic Complexity Index (ECI), which tries to measure capabilities indirectly by looking at the mix of products that countries export.

The assumption is that productive capabilities determine the number and quality of products that a country can export; so export bundles tell us something about the underlying productive capabilities. For example, we might infer that Switzerland and Japan have similar productive capabilities, because they are both able to produce a similar set of goods.

To use a metaphor: If economies are like restaurants, then productive capabilities are all the stuff that is needed in the kitchen; so the Economic Complexity Index ranks the restaurants by comparing the menus, rather than by comparing the recipes, food and people behind the kitchen doors.

In a nutshell, the ECI is an algorithm such that (i) restaurants that serve a more diverse and sophisticated menu are scored higher, and (ii) restaurants that serve similar menus have similar scores.

A closer look at the Economic Complexity Index

The ECI takes data on exports, and reduces a country’s economic system into two dimensions: (i) The 'diversity' of products in the export basket, and (ii) the ‘ubiquity’ of products in the export basket. Diversity is the number of products that a country can export competitively. And ubiquity is the number of countries that are able to export a product competitively.

To measure these two dimensions, the ECI uses a cross-country export matrix. That is, a table with countries in the rows and product categories in the columns, so that each cell in the table shows the value of country-product exports.

Loosely speaking, the least complex countries, at the bottom of the ECI rank, are those that export very few different types of products (i.e. have export baskets that are not diversified) and those products that they do export are produced in many other countries (i.e. export baskets that load heavily on just a few ubiquitous products).

By this logic, Germany ranks high in economic complexity, because it exports many different kinds of sophisticated things that are only produced by a handful of other countries with similarly diversified productive capacities.

The following chart shows ECI rankings for all countries in the world, over time.

MIT's Observatory of Economic Complexity and Harvard's Atlas of Economic Complexity are both great data visualisation websites that have much more data on ECI, countries' trade relationships, and the composition of traded goods.

From economic complexity to economic growth

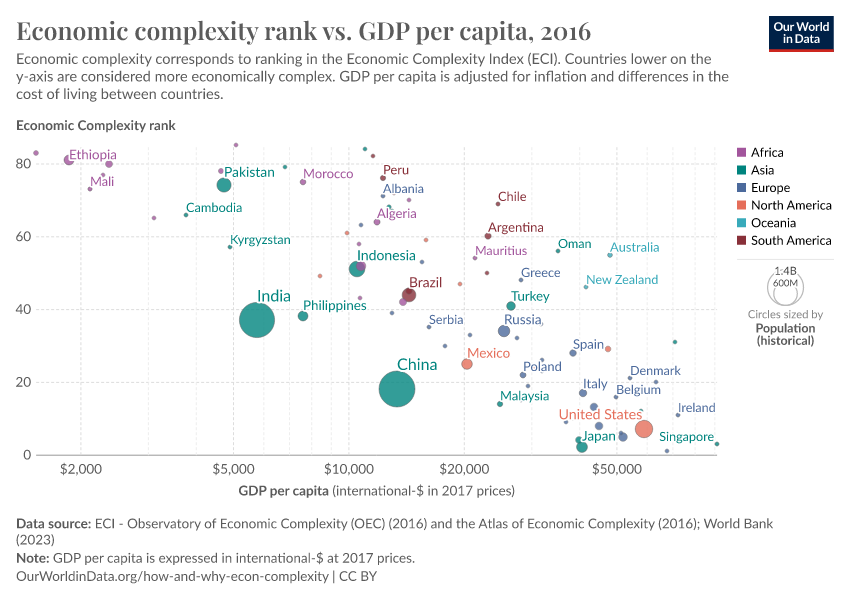

The chart below shows the relationship between ECI rankings and GDP per capita. As we can see, there is a clear correlation: richer countries tend to rank higher in the ECI. The countries on the lower ranks of the ECI are much poorer than the high-ranked countries in the top-left corner.

In the academic paper where Hidalgo and Hausmann introduced their concept of ‘economic complexity’, they noted that the correlation between the ECI and GDP per capita is very robust; and they showed that, beyond this, the ECI actually predicts economic growth after statistically controlling for other baseline country characteristics. So countries with higher economic complexity than their level of GDP per capita would suggest, can be expected to grow faster.

Consider, for example, Malaysia: As we can see in the chart above, Malaysia is further down along the vertical axis than other countries located at the same height along the vertical axis. So, statistically speaking, it is likely that Malaysia will grow faster than these other countries.

The intuition for why economic complexity predicts growth can be understood in terms of unexploited productive potential. Countries that are below the income expected from their capability endowment, are countries that will likely shift towards the product-mix that is feasible with their existing capabilities, and which richer countries have already successfully developed.

This takes us to the main lesson from economic complexity: Different types of exports are associated with different economic outcomes. 1

This is in line with the well-studied phenomenon of ‘premature de-industrialization’. Emerging economies that fail to develop their manufacturing sector as they grow, are likely to suffer from lower growth prospects later down the line, because manufacturing industries tend to be particularly conducive to productivity growth. (You can read more about ‘premature de-industrialization’ in our blog post here.)

What does this mean in terms of economic policy?

The fact that different types of exports are associated with different economic outcomes suggests that policymakers should try to focus on relaxing specific productivity constraints in key sectors that are likely to unlock growth potential.

Does this imply that countries that are less economically complex, as determined by the ECI, should focus on diversification? Not necessarily.

The type rather than the number of industries and occupations concentrated in a region might matter more for economic prosperity. So the objective of industrial policy should not be diversification per se.2

Pinning down the ‘key sectors’ and finding ‘binding constraints’ is obviously difficult. But it is likely more cost-effective than a one-size-fits-all approach to industrial policy.

Acknowledgements

We thank Penelope Mealy for helpful comments and suggestions on earlier draft versions of this blog post.

Endnotes

It's not only about GDP growth. In a recent paper Hartmann, D., Guevara, M.R., Jara-Figueroa, C., Aristaran, M., Hidalgo, C.A., suggest the ECI is a predictor of income inequality levels. They show that countries exporting more economically complex products have lower levels of income inequality than countries exporting more ubiquitous products. Available online here.

For more details on this see Mealy, P., Farmer, J., & Teytelboym, A. (2018). A New Interpretation of the Economic Complexity Index. Available online here.

Cite this work

Our articles and data visualizations rely on work from many different people and organizations. When citing this article, please also cite the underlying data sources. This article can be cited as:

Esteban Ortiz-Ospina and Diana Beltekian (2018) - “How and why should we study ‘economic complexity’?” Published online at OurWorldinData.org. Retrieved from: 'https://ourworldindata.org/how-and-why-econ-complexity' [Online Resource]BibTeX citation

@article{owid-how-and-why-econ-complexity,

author = {Esteban Ortiz-Ospina and Diana Beltekian},

title = {How and why should we study ‘economic complexity’?},

journal = {Our World in Data},

year = {2018},

note = {https://ourworldindata.org/how-and-why-econ-complexity}

}Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license. You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.